Company News View All

Jenni Chamberlain to Speak at AVCA Conference on 26 April 2024

Please find the below link for the article...

Altree Capital invests in Burton & Bamber's sustainable growth...

Please find the below link for the article...

Celebrating excellence - the women-founded and -led companies that work with Altree...

Please find the below link for the article...

Uncover Skincare Experience Grand Opening & I Am Restored Blemish Serum Launch ...

Please find the below link for the article...

Wahu! Mobility launches Ghana’s first electronic vehicle plant ...

Please find the below link for the article...

Altree Capital backs Wahu Mobility...

Please find the below link for the article...

Kasha raises $21M Series B led by Knife Capital to expand health access platform across Africa...

Please find the below link for the article...

Altree Capital successfully invests in Kasha...

Please find the below link for the article...

Altree Capital concludes investment in Uncover...

Please find the below link for the article...

Prosper Africa congratulates Altree on receiving Visa's grant funding

Please find the below link for the article...

Three African women fund managers receive grant funding from Visa Foundation

Please find the below link for the article...

Altree Partners with Visa Foundation

Please find the below link for the article...

Altree Capital 2022 Review and Outlook for 2023

Please find the below link for the article...

Altree Partners with Prosper Africa

Please find the below link for the article...

Foreign Investors Are Computing Their Own Forex Rate in Nigeria

Please find the below link for the article...

WEMI Fund Manager Programme Selects Altree and 11 other Southern African Women Fund Managers

Please find the below link for the article...

Conversations with the Cohort: Altree Capital

Please find the below link for the article...

27 April 2021 - Webinar on The Road to Local IPOs

Please find the below link for the webinar access from June 10 at 1pm GMT / 8am EST...

10 June 2020 - Webinar on African equities investing access link

Please find the below link for the webinar access on June 10 at 1pm GMT / 8am EST...

Africa Opportunities Impact Fund COVID-19 Report

COVID-19 reinforces the need for Africa to accelerate food production and improve security of supply ...

Jenni Chamberlain Named to Africa AM Power 50

Jenni Chamberlain named to the Africa AM Power 50 for second consecutive year...

Africa Opportunities Fund wins Africa ex-South Africa Fund of the Year

Altree Capital, the Pan-African asset management house, received top honors at the Inaugural Africa Fund Manager Performance Awards...

News

- Articles

- Company News

- Jenni Chamberlain to Speak at AVCA Conference on 26 April 2024

- Altree Capital invests in Burton & Bamber's sustainable growth

- Celebrating excellence - the women-founded and -led companies that work with Altree

- Uncover Skincare Experience Grand Opening & I Am Restored Blemish Serum Launch

- Wahu! Mobility launches Ghana’s first electronic vehicle plant

- Altree Capital backs Wahu Mobility

- Altree Capital successfully invests in Kasha

- Altree Capital concludes investment in Uncover

- Kasha raises $21M Series B led by Knife Capital to expand health access platform across Africa

- Prosper Africa congratulates Altree on receiving Visa's grant funding

- Three African women fund managers receive grant funding from Visa Foundation

- Altree Partners with Visa Foundation

- Altree Capital 2022 Review and Outlook for 2023

- Altree Partners with Prosper Africa

- Foreign Investors Are Computing Their Own Forex Rate in Nigeria

- WEMI Fund Manager Programme Selects Altree and 11 other Southern African Women Fund Managers

- Conversations with the Cohort: Altree Capital

- Webinar on The Road to Local IPOs

- Webinar on African Equities Investing

- Africa Opportunities Impact Fund COVID-19 Report

- Jenni Chamberlain Named to Africa AM Power 50

- Africa Opportunities Fund wins Africa ex-South Africa Fund of the Year

- Press Releases

- Print Media

- References

- Publications

Foreign Investors Are Computing Their Own Forex Rate in Nigeria

18 November 2022

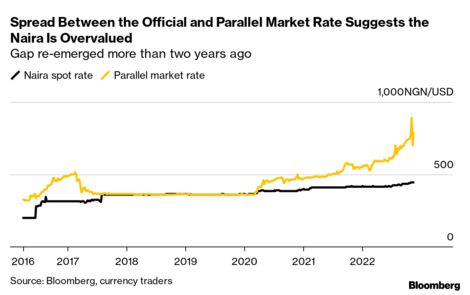

While the naira trades at an official and a vastly weaker parallel rate due to a chronic dollar shortage, foreign investors are using their own calculations to value their trapped Nigerian assets.

One alternative level is derived from pricing for two stocks listed in both Lagos and London -- Airtel Africa Plc and Seplat Energy Plc. The result provides a realistic valuation for the potential sale of holdings on the Nigerian Stock Exchange, said Jenni Chamberlain, a portfolio manager at Altree Capital Ltd.

“We mark our portfolio at an implied exchange rate obtained by using the average implied exchange rate from Airtel and Seplat prices in London and on the NSE,” Chamberlain said in an emailed response to questions. “This rate trades closer to the black market rate, but I know we can realize this valuation if required.”

While the naira has officially weakened by only about 4% against the dollar this year, that rate is inaccessible to many foreign portfolio managers seeking to repatriate funds from Nigeria due to a lack of hard currency. The International Monetary Fund has estimated that as much as $1.7 billion of investor funds could be trapped in Africa’s largest economy.

Many businesses and investors are more likely to get their dollars from the parallel market, where the greenback is freely traded but at a premium of almost 80% to the official spot rate. While the naira traded just below 444 a dollar on Thursday, the parallel-market rate was 793 per dollar.

Airtel closed at 116.2p in London on Wednesday, compared with 1,270 naira in Lagos -- equivalent to £2.41 at the official rate. For Seplat, the levels were 96.2p against 1,089 naira -- or £2.07.

Altree, incorporated in Bermuda, utilizes the Seplat-Airtel derived rate “as we believe it is a fair reflection of where we would be able to realize our Nigerian exposure today should we require the liquidity,” Chamberlain said.

The Nigerian situation has echoes of one in Zimbabwe, where analysts used to assess how out of sync Zimbabwean equities were due to rampant inflation by measuring the difference between the London and Harare stock of insurer Old Mutual Ltd., Africa’s largest insurer. Old Mutual’s Harare shares were suspended in 2020 after authorities blamed moves in the stock for fueling a collapse in the local currency.

Nigeria’s parallel-market naira rate is “certainly” much closer to a fair level than the official one, “which is very overvalued,” said Kevin Daly, a portfolio manager at abrdn in London. The firm sold its Nigeria assets in 2020 because of capital control concerns and will only return after the currency is weakened and bond rates are higher, Daly said.

Eleven out of 13 participants in a Bloomberg poll predict the central bank will devalue the naira in 2023 after allowing it to weaken three times since March 2020.

Please click here for the the article.